Table Of Content

However, the high APY is usually only applicable on a low balance amount. With a CD, the larger your deposit, the higher the rate that you’ll earn. With a high-yield checking account, small deposits earn a higher rate, while large deposits earn a lower rate. Down Payment Assistance Programs—Local county or city governments, local housing authorities, and charitable foundations sometimes provide grants to first-time home-buyers.

Year Fixed Vs. 30-Year Adjustable-Rate Mortgage (ARM)

Another factor in monthly mortgage payments is the length of the loan. A 15-year mortgage will have significantly higher monthly payments but a lower interest rate than a 30-year mortgage. Conventional loans are backed by private lenders, like a bank, rather than the federal government and often have strict requirements around credit score and debt-to-income ratios.

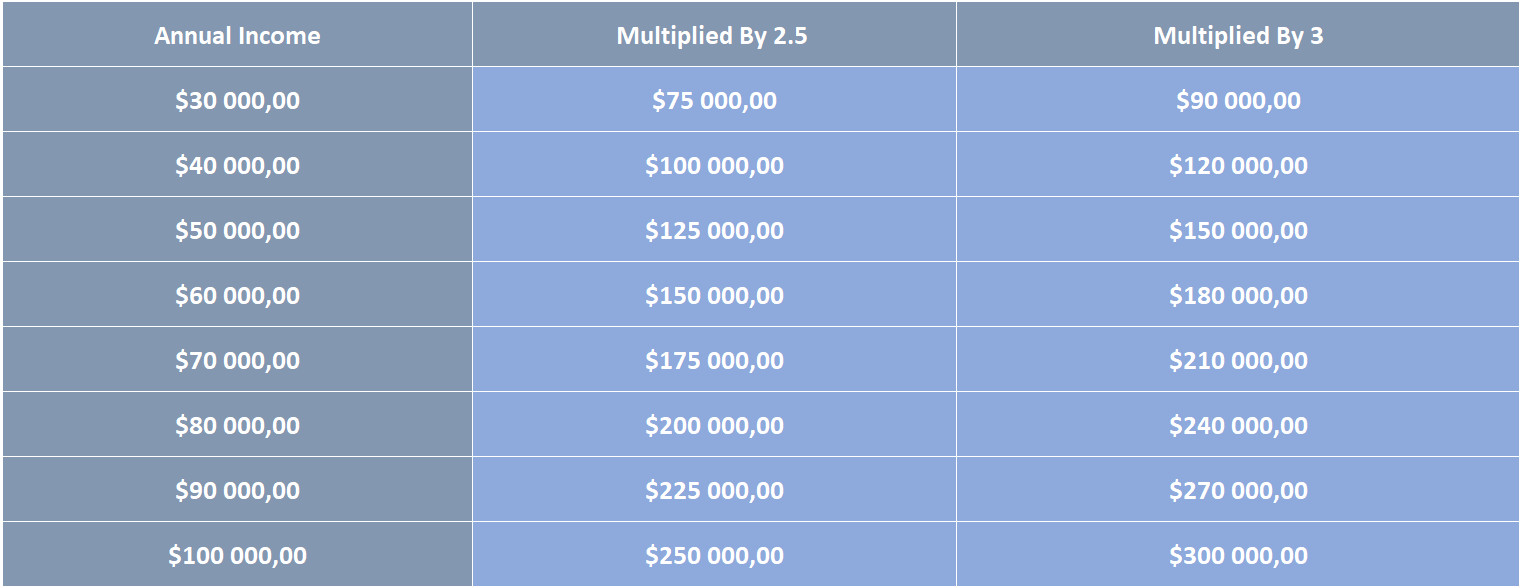

What factors determine how much you can afford?

You’ll need a down payment of $9,000, or 3 percent, if you’re buying a $300K house with a conventional loan. Meanwhile, an FHA loan requires a slightly higher down payment of $10,500, which is 3.5 percent of the purchase price. Many states offer unique programs designed to assist first-time home buyers, especially those struggling with the down payment for a $300K house. These programs often include low-interest loans, grants, or tax credits tailored to make homeownership more accessible. Down payment requirements for condo purchases will vary from single family houses. Each condo building has a different set of rules based on their association.

Questions To Ask A Mortgage Lender

The Middle-Class Crunch: A Look at 4 Family Budgets (Published 2019) - The New York Times

The Middle-Class Crunch: A Look at 4 Family Budgets (Published .

Posted: Thu, 03 Oct 2019 07:00:00 GMT [source]

The average down payment for a house in California typically ranges between 15% to 20% of the purchase price, but can vary depending on your mortgage lender and financial situation. An adjustable-rate mortgage (ARM) varies based on interest rate trends. ARMs are considered riskier because your monthly payments could increase dramatically when rates climb. However, they are sometimes preferred when interest rates are high because your monthly payments will decrease when rates drop. Ideally buyers would be able to put down at least 20% of the home price to avoid paying private mortgage insurance, but it’s not a requirement.

Use the Home Price

A significant down payment also strengthens your mortgage application, potentially offering you better interest rates and terms. If rates fall after you lock in your rate or after you close on your purchase, you will likely be able to obtain a “no cost” refinance from your mortgage lender. But, nonetheless, you do want to track the market and try lock your rate at the most opportune time to keep your monthly mortgage payments manageable and your dream home affordable. It’s equally important to consider the loan term and interest rate when determining if mortgage payments on a $300,000 loan will be feasible for you.

Conventional loans that are Jumbo loans are not eligible for these programs as they are above the limits for such programs. These costs can easily add into the thousands, requiring additional savings beyond the down payment itself. The tables below outline four different down payment options and loan amounts, as well as the related mortgage payments for all those loan amounts – with four different interest rate scenarios. The purpose of this is to give you an understanding of how much interest rate movement will impact your mortgage payment. Navigating through mortgage loan options for a home purchase illuminates the significance of comprehending various down payment requirements per loan type.

A mortgage loan term is the maximum length of time you have to repay the loan. Longer terms usually have higher rates but lower monthly payments. It is possible to pay down your loan faster than the set term by making additional monthly payments toward your principal loan balance. The down payment requirements for a conventional loan on a primary residence vary depending on the lender, the borrower and the property type. For example, first-time homebuyers and buyers with low to moderate incomes could qualify for a fixed-rate conventional loan with a 3 percent down payment. Credit scores in the calculator are used just to determine private mortgage insurance costs.

It will help you determine what size down payment makes more sense for you given the loan terms. A down payment is the portion of the home purchase the buyer makes in cash upfront, with the rest of the purchase covered by the mortgage. For conventional and FHA loans, a down payment is required to buy a home.

We Make $300k Per Year And Own A Sengkang Grand Residences 4-Bedder: Should We Keep Or Sell It To Buy 2 ... - Stacked

We Make $300k Per Year And Own A Sengkang Grand Residences 4-Bedder: Should We Keep Or Sell It To Buy 2 ....

Posted: Fri, 15 Mar 2024 07:00:00 GMT [source]

Most banks and credit unions allow you to set up automatic transfers from your checking account to your savings account. For example, Wells Fargo allows automatic transfers from your Wells Fargo checking account to your Wells Fargo Way2Save Savings account. What if you need to have a down payment saved up in a year or less? If you’re in a time crunch and need to boost your savings now, there are a few things you can do to speed up the process. If the home price is $500,000, a 20% down payment is equal to $100,000, resulting in a total mortgage amount of $400,000 ($500,000 - $100,000). 401(k)—It is possible to take out a loan for either up to $50,000, or half the value of the 401(k) account, whichever is less.

While your lender may be comfortable with lending you money with a low percentage down payment, many condo buildings have maximum financing restrictions. Generally, condos require owners to purchase with a minimum down payment of 10%, or 90% max financing, but this can vary from building to building. If you feel confident in your monthly mortgage payment estimates, you can start the application process. Here is what it will look like from your first contact with lenders to your closing date.

A higher credit score can provide more favorable loan terms and down payment flexibility. Conversely, a lower score may require a larger down payment to compensate for the lender’s increased risk. FHA and VA loan interest rates, however, are much less sensitive to credit scores.

With some commitment and strategies, you’ll be able to save enough to make your mortgage’s down payment requirements. Rates, terms, programs and underwriting policies subject to change without notice. Some products may not be available in all states and restrictions may apply.This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply. Embarking on the homeownership journey, especially when considering how much down payment you need for a $300k house, involves navigating numerous financial considerations. Putting 20% down on a $300,000 home requires a $60,000 down payment. However, this size of a down payment isn’t typically required for a loan.

FHA loans are enticing for buyers who need capital after closing a deal, but not all buyers qualify for these programs. If a single Californian is purchasing a home for themselves, they must make less than $95K. Two people buying a house together cannot earn over $150,000 combined before taxes if they plan to use FHA loans. Lenders often have lower interest offers to buyers who want 15-year loans. While your mortgage will be higher with a 15-year loan term, it’s not as simple as doubling the expected monthly payment. Your payment might only be a little larger because of what you save on interest.

No comments:

Post a Comment