Table Of Content

Here are a few options to consider as you start your mortgage research. The loan term is one of the biggest elements of a mortgage payment that you have in your control. While a 30-year loan has lower monthly payments, it also usually comes with a higher interest rate.

Mortgage options and terminology

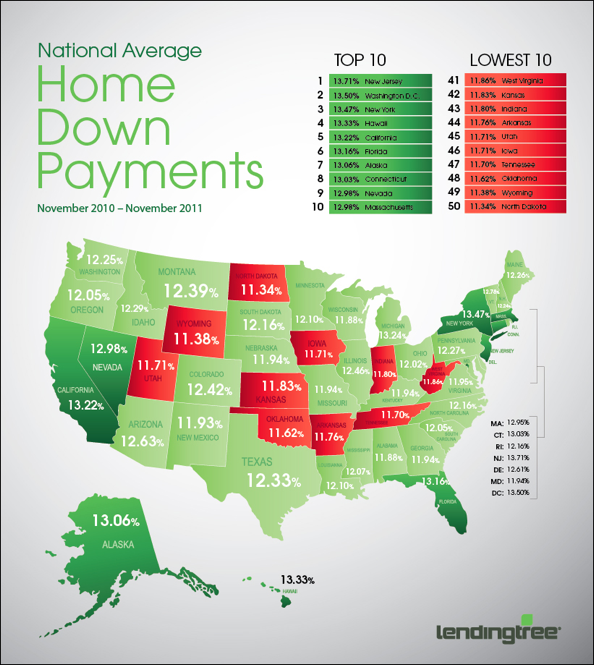

You should also account for the ongoing costs of homeownership, like maintenance and upkeep. A down payment is a portion of the cost of a home that you pay up front. Generally, the more you put down, the lower your interest rate and monthly payment. There are also low or no-down payment options available on certain types of mortgage products, to qualified home buyers.

What factors determine how much you can afford?

In San Francisco, the salary needed to buy a median-priced home soared to more than $402,000 and, in San Jose, a salary of more than $363,000 was needed to make the monthly mortgage payments. In Anaheim, home buyers needed about $254,000 a year, followed by Oakland, with a required salary of $247,559, and Los Angeles. Redfin’s study compared median monthly mortgage payments in October 2022 and October 2021, and considered an affordable monthly payment to be no more than 30% of the home buyer’s income. Once you request a mortgage with a down payment lower than 20%, the lender will arrange PMI with an insurance broker and layer the insurance cost into the transaction. Buyers can either pay a monthly premium for the insurance or a one-time upfront premium when a deal closes. Some lenders provide conventional loans and will not require PMI, but the interest rate may vary as a result.

Condos are making comeback in Tucson, priced in the $200K-$300K range - Arizona Daily Star

Condos are making comeback in Tucson, priced in the $200K-$300K range.

Posted: Fri, 04 Feb 2022 15:04:47 GMT [source]

Second homes and investment properties: 10 percent to 25 percent

Your loan amount might be a little higher if your mortgage lender covers your closing costs and other fees related to the loan. Understanding the mortgage application process can empower you to make smart decisions when securing a home loan. This guide will use $300,000 as a benchmark so you can understand mortgages and calculate your payment options. Learn the process of getting a mortgage on a 300k house and apply this math to your current situation. Instead, lenders are primarily focused on your housing expenses – including any taxes, insurance, and association dues – and other ongoing installment or court-ordered payments.

The sooner you reach the 20% ownership threshold on your house, the sooner your lender can cancel the PMI and reduce your monthly payments. The first number to calculate is your down payment, which is the amount you can put toward your house. In 2023, the median down payment was 15%, which is $45,000 for a $300,000 house. However, first-time buyers had an average down payment of 8% and some loans by the Federal Housing Association (FHA) only require a 4% down payment. This means you could potentially buy your $300k house for as low as $6,000 to $12,000 down.

Being house poor means working double time to pay for a house you can’t comfortably afford. Getting a mortgage preapproval will help you stand out when making an offer while providing you with a better picture of exactly how much house you can afford. Once you’ve completed your financial analysis, you can begin researching lenders. Find the one that best meets your needs and begin your application process. With this payment schedule, you’ll pay a total of $718,527 over the 30-year period, with $418,527 of that going toward interest. Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage.

Vehicle loans

If the home price and amount of upfront cash available are known, use the calculator below to calculate an estimate for a down payment percentage. But, a relative can help if he or she is willing to provide gift funds. If you get pre-approved with a reputable mortgage lender, they will keep you apprised of interest rate trends and advise you on the best time to lock in your mortgage rate. Most mortgage advisors recommend locking in your rate as soon as you get into contract to protect you from rising rates. Each loan type has unique benefits and requirements, so consider your financial situation and homebuying goals when choosing the best path forward.

Yes, many loan programs allow you to use gift funds for your down payment. Using gift money for a down payment is a common practice that can help make homeownership more accessible. While eligible $300,000 homebuyers could enjoy homeownership without the initial financial burden of a down payment, they should also know that VA funding fees might be applicable. FHA loans are recognized for their flexibility regarding credit, income, and down payment guidelines. They require a minimum down payment of just 3.5%, which is $10,500 for a $300,000 home. Please also note that mortgage insurance premiums are a requirement for all FHA loans.

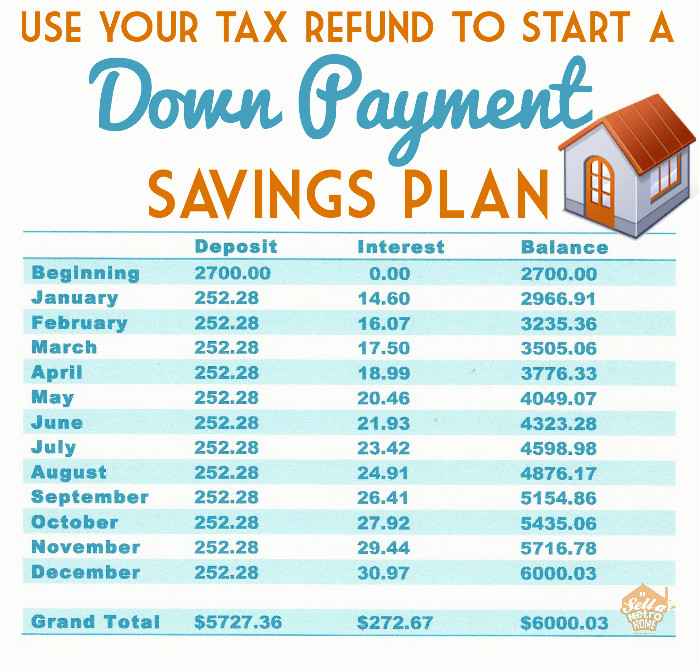

If you had invested your savings, you might have enough money for your down payment. In this case, an annual return of 4.5% would have resulted in $100,000 in five years. A high-yield checking account offers a high interest rate if you fulfill certain requirements. This allows you to unlock a high APY, which can be significantly higher than savings accounts, money market accounts, and CDs.

If your lender covers these costs for you, expect your monthly mortgage payments to be higher than if you paid them on your own. Ultimately, your income and the amount of debt you owe will determine whether you can comfortably afford a $300,000 mortgage. Before deciding whether it’s right for you, take into account your monthly debt payments and additional homeownership expenses, such as energy costs and maintenance fees. The decision to buy a home often comes with a lot of financial questions. One of the most crucial questions you’ll need to answer is how much you can comfortably afford to spend on monthly mortgage payments.

Navigating your mortgage options doesn’t have to be a solo journey. Whether you’re determining how much down payment you need, understanding loan eligibility, or figuring out how to skip mortgage insurance, we’ve got you covered. Click below to explore a simplified path to homeownership, tailor-made to fit your financial situation. Different lenders have different rules, but typically they require a 620 credit score for conventional loan approval.

Homeowners in some developments and townhome or condominium communities pay monthly Homeowner's Association (HOA) fees to collectively pay for amenities, maintenance and some insurance. Mortgage interest is the cost you pay your lender each year to borrow their money, expressed as a percentage rate. With a 10% down payment option, you may still qualify for a conventional mortgage, but you may need to pay for PMI. Some 401(k) plans also permit loans or withdrawals for home purchases. However, this strategy requires careful consideration due to potential tax implications and the impact on future retirement savings. Eligibility criteria can include income levels, property location, and the buyer’s status as a first-time homeowner.

Shop around to different lenders to get to know your interest rate options. You can choose a mortgage company that offers favorable rates and safe money on your monthly mortgage payments. Multiple online calculators will help you estimate your monthly mortgage payments. You can also request loan estimates from lenders to see your estimated monthly payments. Determine the level of risk you are comfortable with in your monthly mortgage payments.

If you are looking to buy a house that requires a mortgage above these caps, you’ll need to take out something called a jumbo loan. You can still use the calculator to get a sense of what you might be able to afford, though it will be less accurate. But not all buyers want to lower their down payment, as providing more equity upfront reduces interest rates and chips away at the principal. Regardless of the type of loan, buyers should shop around when looking for mortgages. Buying a home is an exciting prospect, yet it is easy for first-time homebuyers in the Golden State to feel overwhelmed after learning how much money down payments require.

As home prices rise, there is a growing trend of first time home buyers getting help from parents or other family members in the form of a gift. Many lenders allow gifting so long as a buyer’s financial situation justifies the loan during underwriting. Mortgages issued by lenders require an investment of capital from buyers to secure financing, and the type of loan dictates the required down payment. Buyer’s brokers commonly field questions about how much should be saved up for a down payment when buying a home in California, and the answers differ for all buyers. Your monthly payment calculation will vary depending on the type of mortgage you have.

If regular transfers don’t work out for you, such as if you have irregular income, you can always schedule one-time transfers for a future date. For example, if you expect to receive a sum of money three months from now, you can schedule a one-time transfer to your savings account ahead of time. For 2022, the conforming loan limit for most counties is set at $647,200 which is the base limit. In some high-cost counties such as New York City and Los Angeles, the limit is $970,800 which is $323,600 or 50% higher than the base limit. Therefore, if your mortgage size in New York City is $1,000,000, it is not a conforming loan and is considered a Jumbo Loan. It is important to note that different government home loan programs like those offered by the USDA use different loan limits.

No comments:

Post a Comment